And now you an find every video on YouTube, hence Google video player failed to get income. Google Video launched in late January 2005 and 22 months later Google bought YouTube for $1.65 billion. Now it wasn’t a total failure, idea wise. Either you can modify the product to retarget in different markets or eliminate the product after selling out.įor Google, it killed some of the dog-products because they acted merely as cash-traps. The product has very less market growth and very less profit. You can also do it product wise, or even department wise! Here I have categorized the above segments into BCG Matrix. Now coming to the BCG Matrix example of Google.

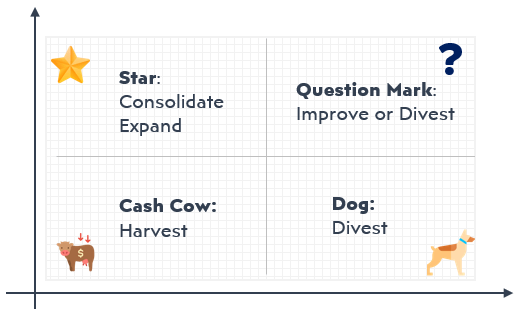

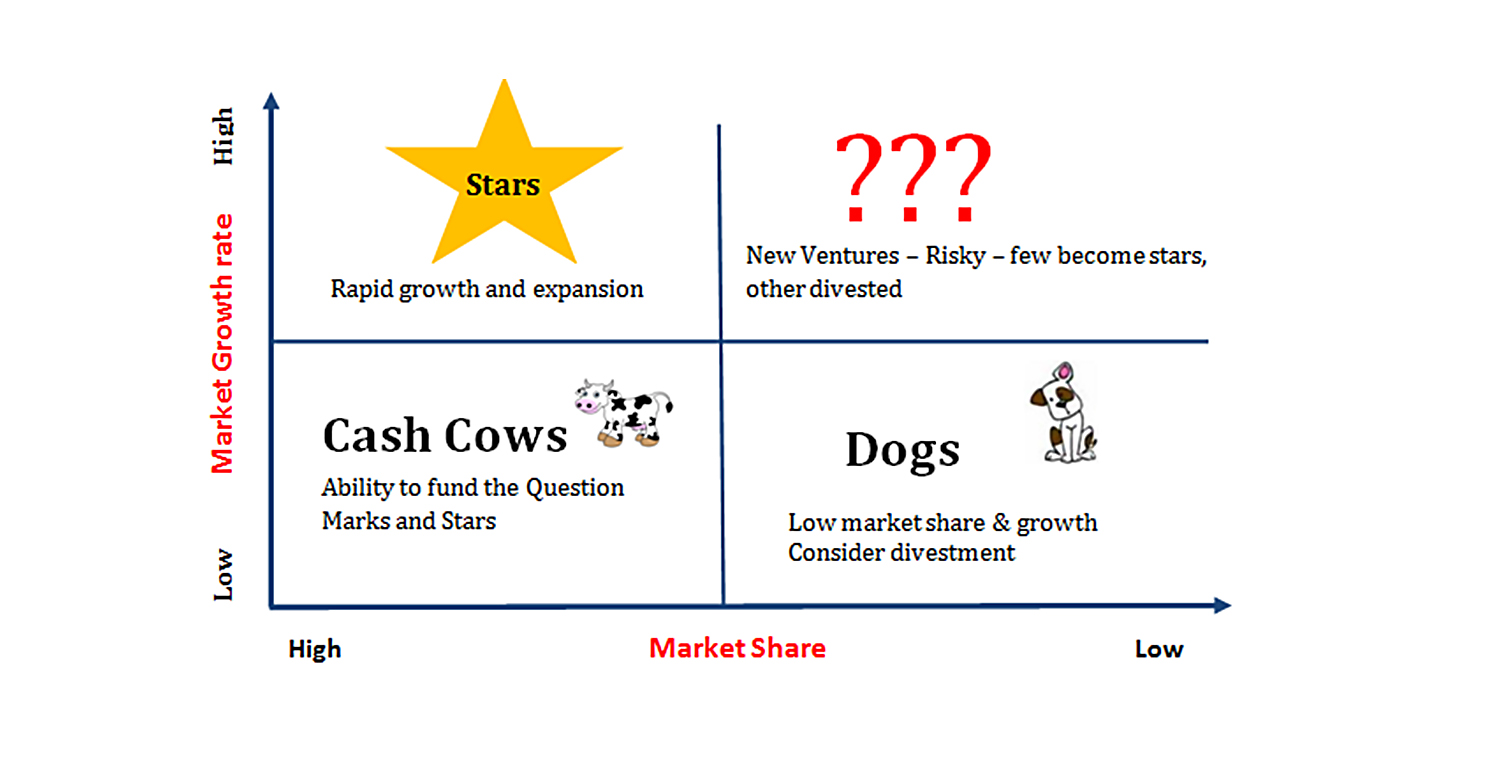

These products are growing at a healthy pace and even competing well across the mobile industry. The Nexus/Pixel products are an example of that. And we all are quite familiar with its hardware products too. Google is investing heavily in the cloud-based services sector. Here is an exclusive list of active and discontinued applications that Google offered for mobile.įor desktops it has options like Google Earth, AdWords Editor, etc. You must be familiar with a ton of mobile applications of Google. And similarly, for desktops it has the Chrome OS for us. One of our favourites “Android”- this Linux based operating system is a product of Google. Along with-it Google also has different set of security tools to prevent bot breaches. Like Google Developers, Gerrit, Google Web Toolkit, etc. Apart from that, it also has other search tools, advertising services, communication and publishing tools etc.Įven statistical tools like Google Analytics comes under this.Įven for software developers, it has a lot of applications for different platforms. Under this category you can find Google’s search engine. Now lets see what the 4 broad categories are, and how are they interpreted by business.įor an easy approach, I have categorized the plethora of products into few categories: For that I suggest, you follow the following link!īCG MATRIX: CONSTRUCTION AND ANALYSIS IN EXCEL WITH EXAMPLEīy now you understood how the BCG matrix of drawn. If you can get some data of for this matrix, do try to solve it on Excel. We can see here that the axis is not linear in nature.

And the division takes place at 10-15% value. And probably already dominates the existing market.

We don’t use it beyond that! Because a value of “4” tells us that your brand’s market share is way ahead of your next rival. So, they can make strategic decisions to increase sales.īut in the industry, the value usually ranges from 0.1 to 4. Relative market share allows companies (and their investors) to see how they're faring in terms of their largest competitors. You use “next largest competitor’s data”, in case your firm is the largest one. Relative Market Share (%) = Brand’s Market Share ÷ Largest competitor’s market share

0 kommentar(er)

0 kommentar(er)